|

Getting your Trinity Audio player ready...

|

What is Home Office Deduction?

The expression “home” incorporates a house, loft, condo, manufactured home, boat, or comparative property which gives essential living facilities. It likewise remembers structures for the property, like an unattached carport, studio, animal dwelling place, or nursery. In any case, it does exclude any piece of your property utilized solely as an inn, motel, hotel, or comparative foundation.

On the off chance that you use part of your home only and routinely for leading business, you might have the option to deduct costs, for example, mortgage interest, insurance, utilities, fixes, and depreciation for that space. You need to sort out the level of your home gave to your business exercises, utilities, fixes, and depreciation.

Requirements to Claim the Home Office Deduction

Despite the technique picked, there are two fundamental prerequisites for your home to qualify as an allowance:

1. Regular and exclusive use.

2. Principal place of your business.

1. Regular and Exclusive Use.

You should routinely utilize part of your home solely for leading business.

For instance, on the off chance that you utilize an additional space to maintain your business, you can take a work space allowance for that additional room.

2. Principal Place of Your Business

You should show that you utilize your home as your chief business environment. In the event that you direct business at an area outside of your home, yet additionally utilizes your home considerably and consistently to lead business, you might meet all requirements for a work space deduction.

For example, on the off chance that you have face to face gatherings with patients, customers, or clients in your home in the typical course of your business, despite the fact that you likewise carry on business at another area, you can deduct your costs for the piece of your home utilized solely and consistently for business.

Trade or Business Use

To qualify under the exchange or-business-use test, you should utilize part of your home regarding an exchange or business. On the off chance that you utilize your home for a benefit looking for action that isn’t an exchange or business, you can’t take a deduction for its business use.

For example: You use part of your home solely and consistently to peruse monetary periodicals and reports, cut bond coupons, and do comparative exercises identified with your own speculations. You don’t make speculations as an intermediary or seller. In this way, your exercises are not piece of an exchange or business and you can’t take an allowance for the business utilization of your home.

In the event that the utilization of the work space is simply suitable and accommodating, you can’t deduct costs for the business utilization of your home.

Home Office Deduction Method:

1. Simplified Method.

2. Based on actual expenses on form 8829.

1. Simplified Method: The simplified strategy is an option in contrast to the estimation, portion, and validation of genuine costs. As a rule, you will calculate your deduction by multiplying $5, the endorsed rate, by the space of your home utilized for a certified business use. The region you use to calculate your allowance is restricted to 300 square feet.

2. Based on actual expenses on form 8829: If you figure your deduction for business use of the home using actual expenses in a subsequent year, you will have to use the area used for business purpose and total area of home. The deduction is limited to business use of total area. You will have to prepare form 8829 to figure out home office deduction.

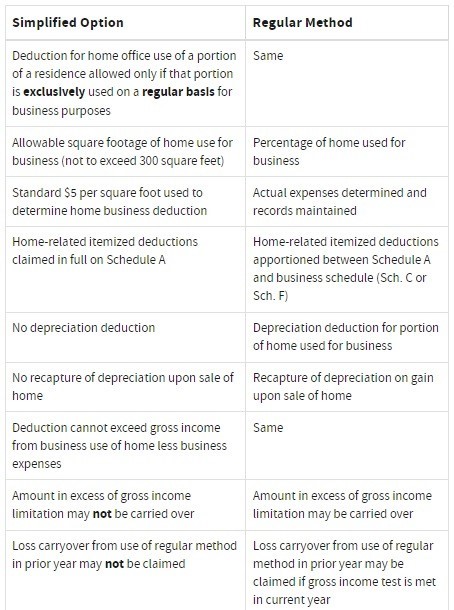

Comparison of Methods

Selecting a Method

- You might decide to utilize either the improved on strategy or the standard technique for any available year.

- You pick a technique by utilizing that strategy on your convenient recorded, unique government personal expense form for the available year.

- Once you have picked a technique for an available year, you can’t later change to the next strategy for that very year.

- If you utilize the improved on strategy for one year and utilize the standard technique for any resulting year, you should compute the depreciation allowance for the ensuing year utilizing the proper discretionary depreciation table. This is valid whether or not you utilized a discretionary depreciation table for the main year the property was utilized in business.

Your work space deduction is restricted if your costs are more than your business pay for the year. The business use of home expense cannot make the Schedule C income goes below zero.”On the off chance that there is unused business usage of home expenses, it will continue to the next year as long as they worked on system is used. On the off chance that the improved on technique is utilized, the remainder is denied.”

So if you have business which is using part of your home than don’t forget to claim this deduction to reduce your tax liability on tax return.

In the event that I work from home, do I meet all requirements for a work space deduction?

In case you’re a worker working distantly as opposed to a business or entrepreneur, you lamentably don’t fit the bill for the work space charge deduction (in any case, kindly note that it is as yet accessible to some as a state charge allowance). Preceding the Tax Cuts and Job Acts (TCJA) charge change passed in 2017, workers could deduct unreimbursed employee costs of doing business, which incorporated the work space deduction. Nonetheless, for charge years 2018 through 2025, the separated allowance for representative operational expense has been dispensed with.

To know more about How Home Office Deduction can reduce your tax burden? Connect with our team call us on +1 929 254 6300 or email us on contact@crspconnect.com or planning to outsource your accounting services and tax preparation services.